what is considered open end credit

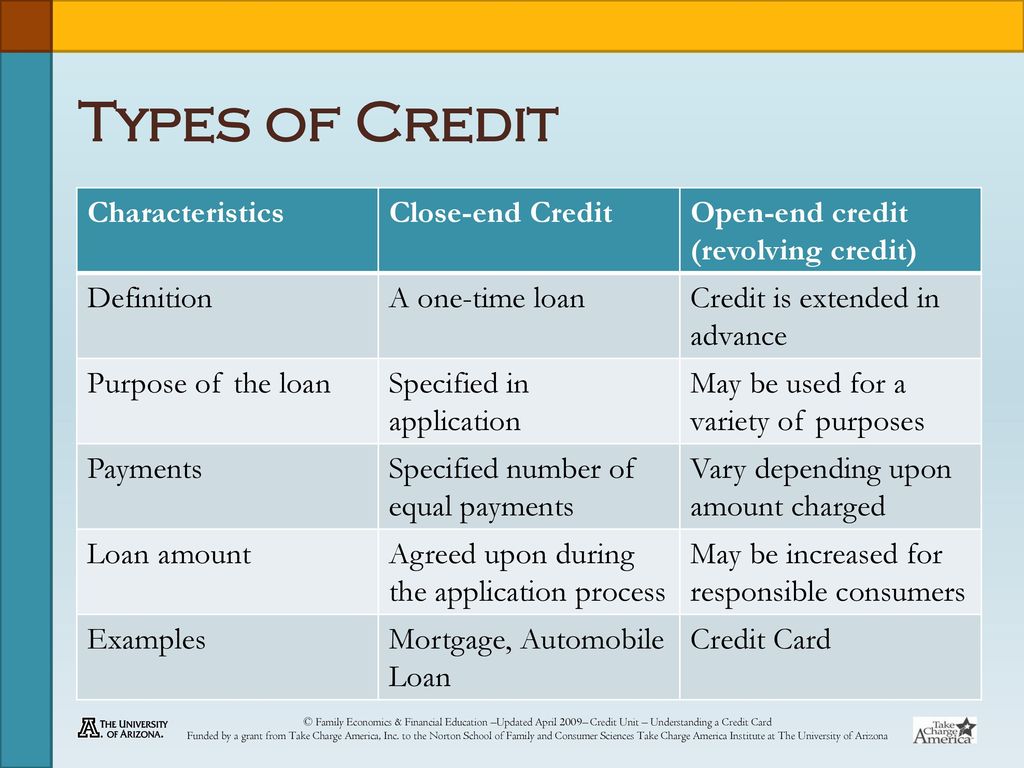

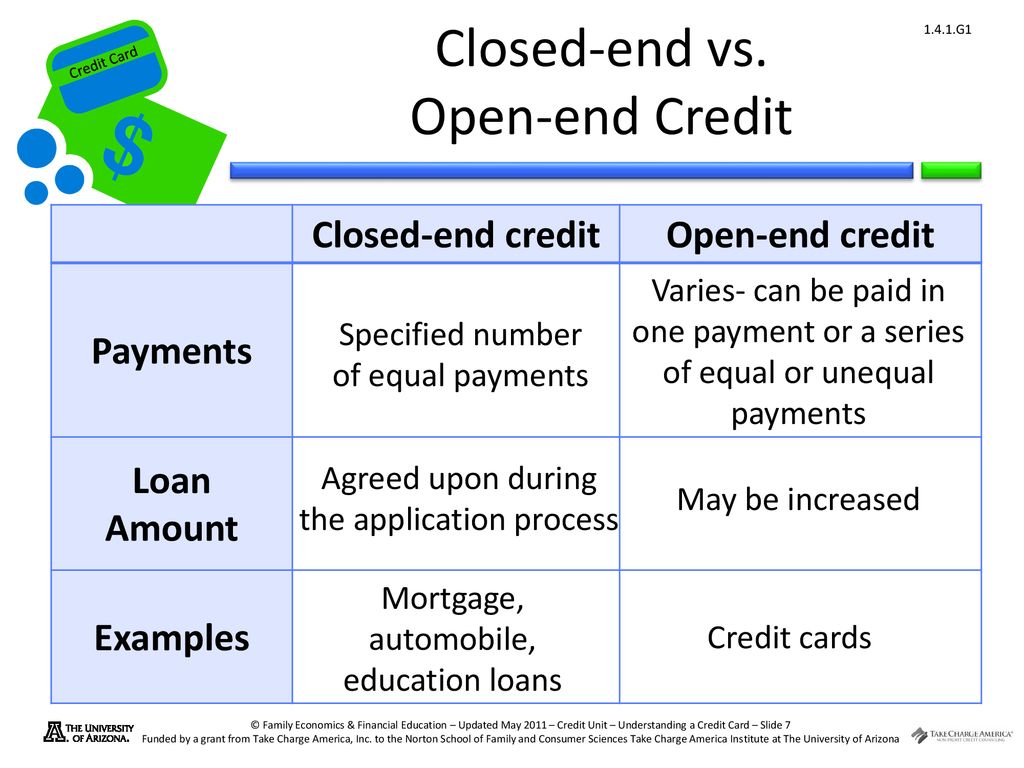

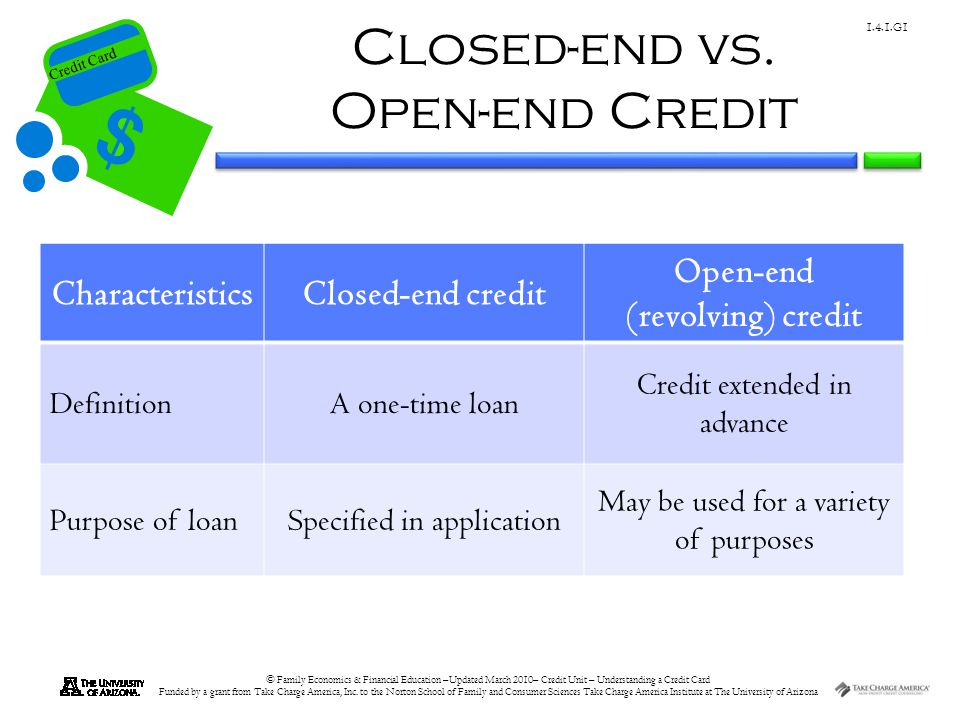

Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to. Open-end credit and Closed-end credit.

:max_bytes(150000):strip_icc()/LOC-d08bea479118495ab00b6f6cd8c7641c.png)

Line Of Credit Loc Definition Types And Examples

General the term open-end credit means consumer credit extended by a creditor under a plan in which.

. You are given the privilege of paying the balance in full or. Open-end credit is a. With a credit card you have a certain amount.

Open-end credit also i See more. An open-end consumer credit account is a credit card account under an open-end not home-secured consumer credit plan for purposes of 10262a15ii if. A loan given for a short period of time that is not dependent on credit history Open-end credit is an agreement with an institution on a certain amount that can be.

An open end credit account is one under which you are allowed to make repeated purchases or obtain loans. Open-ended credit or revolving credit gives the borrower an amount to draw from that can be continually reused as its paid. Open-end credit refers to an account that a borrower can use to borrow any amount of money.

Credit cards are the most common form of open. The use of positive numbers also triggers further disclosure. Under a line of credit agreement the consumer takes out a loan that allows payment for expenses using special checks or.

Our Open End Credit study sets are convenient and easy to use. Open-end credit must be repaid over time and generally gives consumers the option of making minimum monthly payments or greater each billing cycle. Open-end credit is a preapproved loan between a financial institutionand borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due.

When you lease a car youll usually be offered a closed-end lease. Line of credit where pays a fee to borrow money from a financial institution. What Are Open And Closed End Loans.

Open-end credit allows you to use the same credit for as long as you make the minimum monthly payment on time each month. A line of credit is a type of open-end credit. Any sort of loan that allows you to make several withdrawals and repayments is known as open-end credit.

Open end credit helps the borrower to control the amount they borrow. With open-end credit youre only required to make a small minimum payment toward your outstanding balance each month. Open end credit allows you to make repeat purchases.

The preapproved amount will be set out in the agreement between the lender and the borrower. What is Open End Credit. Car loans are not open-end credit since open-end credit refers to accounts that you can spend and repay in various amounts as many times as you want.

12 percent Annual Percentage Rate or a 15 annual membership fee buys you 2000 in credit. A credit card a personal line. You can pay the balance in full each month or make installment payments.

On closed-end credit youll have a fixed payment that. Review key facts examples definitions and theories to prepare for your tests with Quizlet study sets.

What Is Closed End Credit Cash 1 Blog News

Corporate Credit Spreads Widen Slightly But Financial Conditions Remain Especially Easy Morningstar

7 Tips On How To Use Your Line Of Credit Wisely Cash 1 Blog News

What Is Closed End Credit Cash 1 Blog News

Understanding A Credit Card Ppt Download

Aqua Finance Welcome Connexus Credit Union

Understanding Your Credit Card Ppt Download

:max_bytes(150000):strip_icc()/GettyImages-707452833-5ae73fce43a1030036ceb1d6.jpg)

How Closed End Credit Is Paid Off

Credit Market Insights A Decidedly Negative Quarter For Fixed Income Markets Morningstar

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Understanding Open End Credit Youtube

Investment Grade Bonds Catch A Bid In July Morningstar

Synonyms For Open End Credit Thesaurus Net

What Is An Open End Loan Budgeting Money The Nest

Closed End Credit Installment Loans By Mike Fladlien Tpt

Closed End Credit Vs Open End Credit 5115 Youtube

Regulation Z Truth In Lending Flashcards Quizlet